Ready to work with us?

We offer one-on-one coaching for:

- Homeownership

- Financial Empowerment

- Small Business

Financial Opportunities with BCL

BCL Connection

#WeAreBCL: Yeraldin Yordi. Yeraldin’s dedication ensures small business customers are resilient and not only start but successfully navigate to the…

Read More

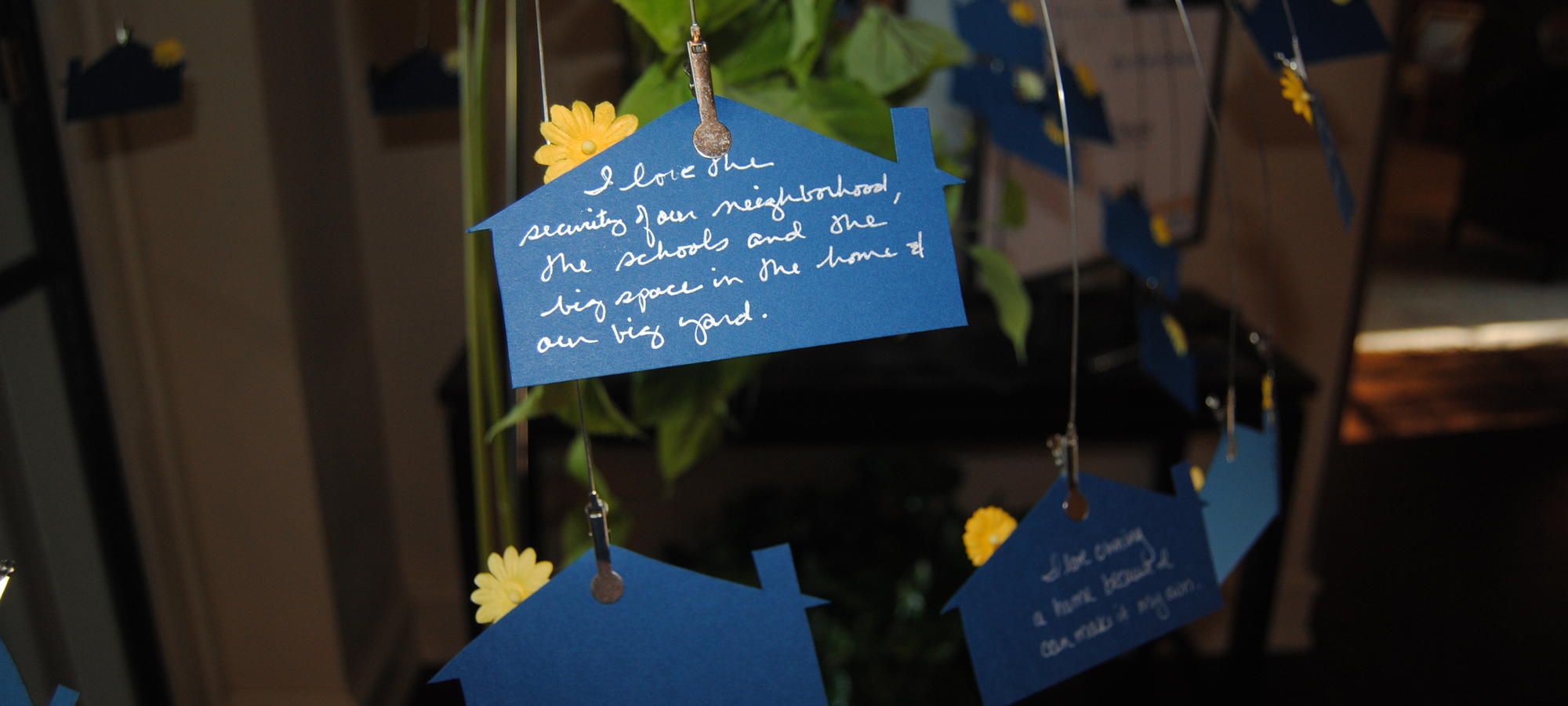

First-Time Homebuyers, Ricky, Jamie & Family

Homebuyer Education & Counseling

Jamie and Ricky had always rented, and when the idea of homeownership came up they weren’t sure where to start. Jamie approached Daniel Garcia at BCL of…

Read More

Where to Find Us

AUSTIN

1011 San Jacinto Blvd

Suite 500 Austin, TX 78701 P: 512.912.9884 F: 346.301.5752 NMLS #1114924

Suite 500 Austin, TX 78701 P: 512.912.9884 F: 346.301.5752 NMLS #1114924

DALLAS

400 S Zang Blvd

Suite 1220 Dallas, TX 75208 P: 214.688.7456 F: 346.301.5752 NMLS #1114924

Suite 1220 Dallas, TX 75208 P: 214.688.7456 F: 346.301.5752 NMLS #1114924

SAN MARCOS

302 W Hopkins St

Suite 2 San Marcos, TX 78666 P: 512.383.0027 NMLS #1114924

Suite 2 San Marcos, TX 78666 P: 512.383.0027 NMLS #1114924