Ready to work with us?

Sign for our monthly e-newsletter to be a BCL of Texas insider and stay in the loop on events, opportunities, and classes.

Texas job growth is expected to continue in 2026, but at a modest pace compared with previous years. This steady improvement suggests the overall economy is strengthening, even as some industries grow slowly. For families and workers, that means more opportunities without rapid inflation or volatility. BCL’s consumer loans and financial education remain critical tools for building stability and confidence in a cautious job market.

After being turned down by traditional lenders and facing startup challenges, like limited capital and existing debt, Tolulope Rowland, APRN, PMHNP-BC, FNP-C, owner of Palm Cedar Primary & Mental Care, refused to give up. Discover how connecting with BCL opened doors not only to funding, but also to valuable resources like AI tools and strategic support.

Victor didn’t know where to start on his path to homeownership. With support from BCL and Homeownership Counselor Eva Reyna, he learned the tools, programs, and guidance he needed. Today, he proudly stands in front of his brand new home, a true example of BCL’s vision in action.

At BCL of Texas, we know that behind every successful small business is a story of passion and purpose. For Kristen Felter, LCSW, that purpose is “helping little kids with BIG feelings.” After two decades of social work – from nonprofits to schools – Kristen founded Kind Therapy Austin eight years ago to provide intensive, specialized support for children and their families.

As her practice grew, Kristen reached a “now or never” milestone: the opportunity to expand into a group practice. She had talented clinicians ready to join her, but they were all “juggling schedules and sharing one tiny office.” Kristen knew she needed a dedicated space – one that could accommodate multiple therapists, parent workshops, and training sessions.

That’s where BCL comes in.

At BCL, we believe capital works best when it stays local, rooted in community and supported by trusted partners.

For over 25 years, BCL has partnered with community and economic development organizations to manage revolving loan funds designed to support small businesses. Many local development corporations see the need to launch lending programs but may lack the internal capacity to structure, underwrite, and service loans over time.

That’s where BCL comes in.

BCL of Texas is more than just a lender; we are a dedicated partner committed to strengthening communities by investing in visionary entrepreneurs. Today, we share the success story of Marguerite Felder, owner of Felder Homes LLC, a firm we proudly supported with a strategic line of credit for land acquisition. Her company is not just building houses—it’s building equity and opportunity in underserved communities across Dallas-Fort Worth.

When Melody Shields, owner of MJS Virtual Assistance, LLC, applied for the South Dallas Fair Park (SDFP) Business Growth Series, she wasn’t just looking for basic business advice. Melody’s company already offers a complex suite of services, from virtual assistance to tax preparation and business brokerage. Her primary motivation for joining the cohort was to strategically streamline these diverse offerings and accelerate her expansion efforts.

At BCL of Texas, we pride ourselves on looking beyond the numbers to see the true potential in the people and organizations we support. That philosophy has never been clearer than in our partnership with Monica Osorio, President and CEO of MPO Solutions, a unique Texas firm that successfully blends Program and Construction Management with specialized Education and Training Services.

More Than a Workout: How BCL of Texas Helped Two Moms Build a Community

At BCL of Texas, we help build strong communities by supporting the dreams of entrepreneurs. We believe that when small businesses thrive, entire communities are uplifted. We recently had the privilege of partnering with Julie Benavides and Nancy Watson, the new co-owners of Blush Boot Camp in Leander, to help them turn their passion for empowering women into a successful business. Their story is a powerful example of how a shared vision, combined with the right support, can overcome significant hurdles.

He had the hope. BCL gave him the how. When Carlos Daniel first walked into the 2024 Austin Homebuyer Fair, he carried with him both hope and uncertainty. Having moved from Venezuela a few years earlier, he dreamed of giving his family a stable home but didn’t know where to begin.

At BCL of Texas, we have the privilege of working with entrepreneurs who are committed to serving their communities. Yeneli Flores-Hurtado, owner of Children’s Town Center Daycare, is a shining example of this. We had the pleasure of sitting down with her to hear her inspiring story of transformation, a journey we were proud to be a part of.

Yeneli came to us with a vision: to acquire a second daycare location in Bastrop, Texas, and transform a neglected space into a safe, welcoming environment for children. The building was an old, dilapidated structure with holes in the walls, outdated floors, and a general state of disrepair. Yet, Yeneli saw its potential. As she told us, “The walls had holes. The floor was really outdated. The carpet was old and dusty, but I had a dream of a second location, and I knew I could make it work.” The location was perfect, with retail, housing, and schools nearby. Her dream, however, hit a significant roadblock.

Traditional banks refused to provide financing, forcing Yeneli into owner financing, a challenging path that nearly ended her dream before it began. With no capital to fund necessary renovations, the building sat empty and uninviting. Parents would tour the facility, but as Yeneli shared, “…the place was not ready to show. The paint is horrible, there are holes in the wall… as a parent, I hated that I had to do tours and people had to see all those things.” Without the ability to enroll new students, there was no way to finance the needed improvements.

That’s where BCL of Texas stepped in. Our team worked with Yeneli to secure a loan to fund the full remodel. Yeneli found the process a breath of fresh air. “BCL of Texas was very easy to work with,” she said. “The openness and the way that [our loan officer] made it so clear, so easy, I mean, as opposed to what I’ve been through before, it was really easy.” The funds were disbursed quickly, allowing her to begin renovations almost immediately. The loan covered a new entrance, fresh paint, new walls to define classrooms, new windows, and even roof repairs.

The results have been transformative. The once-neglected space is now a bright, clean, and safe environment. With renovations well underway, parents are now comfortable paying full tuition rates, and enrollments are on the rise. “This transformation means that parents will have access to daycare in their neighborhood,” Yeneli told us. For Yeneli, this success is about more than just business; it’s about giving back. “To me, it’s not just about being able to run a business… but also having the ability to serve the families of this community. Those that needed a safe and happy place to leave their children.”

We are proud to have supported Yeneli’s vision and look forward to seeing Children’s Town Center Daycare thrive. Her story is a powerful reminder that with the right partner, every entrepreneur has the potential to make a meaningful difference. If you have a business dream that you are struggling to finance, don’t give up, BCL of Texas is here to help.

At BCL of Texas, we’re passionate about helping small businesses overcome challenges and achieve their dreams. So-Han Fan, the owner of West China Tea in Austin, is an entrepreneur who, with the right support, was able to turn obstacles into opportunities. So-Han’s journey truly embodies the spirit of resilience and growth that we love to foster.

Guest blogger Merecia Smith works with families and individuals to help them with smart money management. The start of a new school year is always a busy time, and as parents, our job is to be our children’s lifelong teachers. We don’t always have all the answers, but we can find inspiration to be creative with our own household solutions. This year, I’m focusing on some new back-to-school shopping strategies that will help me save time and money.

It is incredibly rewarding to look back at the journeys of the business owners we have had the privilege to help, and Geoff Chudleigh’s story with Tiki Barrel Pool Service is a great example. Our team here at BCL of Texas are so proud to have played a pivotal role in helping Geoff turn his side hustle into a thriving full-time business.

For David Azuara, starting Always Local Heating & Air Conditioning wasn’t just about building a business—it was about building purpose. David discovered BCL through the Greater Austin Hispanic Chamber of Commerce and was immediately drawn to their mission and approachable team. “We reached out to BCL to get help securing the right kind of funding to grow responsibly.”

Germaine Swenson’s unwavering passion and deep-rooted vision has always moved us. Alongside her husband, Ivan Matula, Germaine owns Munkebo Farm in Manor, TX—named in honor of the Swedish town where her great-grandmother was born. A lifelong lover of nature, Germaine has poured her heart into the land since acquiring the farm in 2000. What she’s created is more than just a working farm—it’s a vibrant, sustainable haven where cattle, hogs, and rows of fresh fruits and vegetables thrive together, all cultivated with dedication, resilience, and purpose.

In 2020, the Travis County (TCTX) Thrive Small Business Program was created to offer a response to the economic crisis related to COVID-19. Business & Community Lenders (BCL) of Texas administered the program which offered reimbursement grants of up to $40,000 from the Coronavirus Relief Funds via the CARES Act and business coaching for 225 local small businesses that met eligibility requirements.

Entrepreneurship has long been praised as a route to eliminate racial wealth gap. For at least three decades, gurus, black and white, have told people if they only left salaried employment and struck out on their own, they could create a path to wealth. This solution has neither been borne out by the evidence on a larger scale over time, nor has it proven to be accurate advice under current circumstances.

Jacques Dilonga was in his car heading back to his office from a lunch break when he heard a radio ad for the Neighborhood LIFT program. He says the words “down payment assistance” caught his ear as he and his partner were in the early stages of looking to buy their first home. They were just getting serious about saving up for a down payment on a house, so the timing of the ad was fortuitous.

BCL of Texas (BCL) is one of four nonprofit organizations to be awarded a grant from Prosperity Now to create a Green Business Accelerator in Dallas. This grant will enable BCL to organize business & entrepreneurial service organizations, community development financial institutions (CDFIs), and other valued partners to support businesses entering the green economy.

In the heart of San Marcos, Texas, Native Blends has become a go-to spot for health-conscious residents craving good coffee, fresh smoothies and juices, and good music. The vibrant shop is the creation of Elmer Moreno, a passionate entrepreneur who turned his dream into a thriving reality in 2021.

Last week, the City of Austin proclaimed November 21st, 2024 to be ROSA RIOS VALDEZ DAY!

October is Women Small Business Month, and as Business and Community Lenders of Texas (BCL) celebrates women-owned small businesses, we are also proud to recognize another significant milestone with the appointment of Raquel Valdez Sanchez as our new President & CEO. Raquel succeeds Rosa Rios Valdez, who founded BCL, and who for 34 years, helped advance economic opportunities for diverse and underserved communities throughout Texas.

Reflecting on your journey, from the time you co-founded BCL in 1990, to today, what are the professional milestones that you feel most proud of?

As the founder of Business and Community Lenders of Texas, I am most proud of three milestones: achieving autonomy and statewide expansion; staying focused on capital formation and leveraging BCL capital for economic sustainability.

Valorie Clemons was born and raised in Austin, and after years of renting, decided to that it was finally time to become a homeowner. She started her home buying journey back in 2019 and was met with unfavorable results. That is until she met the team at BCL, who happened to have an informational booth at a business seminar that was hosted by her church. There she was introduced to BCL for the first time and was invited to their offices to discuss the homebuying process in greater detail.

Miguel and Monica Contreras are no strangers to the restaurant business. The two met 37 years ago, and even then, Miguel expressed to Monica “I want to own a restaurant”. Fast forward to the present, they can proudly claim to have accomplished that goal, with restaurants in both Crystal City and Carrizo Springs, and a new location that just opened in San Antonio two months ago.

#WeAreBCL: Yeraldin Yordi. Yeraldin’s dedication ensures small business customers are resilient and not only start but successfully navigate to the finish line, accessing the funding necessary to thrive and expand!

The National Association for Latino Community Asset Builders (NALCAB) announces that Pamela Garcia has been named a 2024 NALCAB Pete Garcia Community Economic Development fellow.

#WeAreBCL: Ellie Kamouie. Ellie leverages her extensive background in numbers and problem-solving to further BCL’s mission of empowering Texans through homeownership and entrepreneurship.

#WeAreBCL: Paul Randle. Paul, with his inherent business acumen, leadership proficiency, and knack for connecting with people, plays a pivotal role at BCL of Texas, connecting with small business owners and positively impacting the community through his dedication.

#WeAreBCL: Leo Pozzobon. Leo joined our team just over three months ago, and he’s been an indispensable asset ever since.

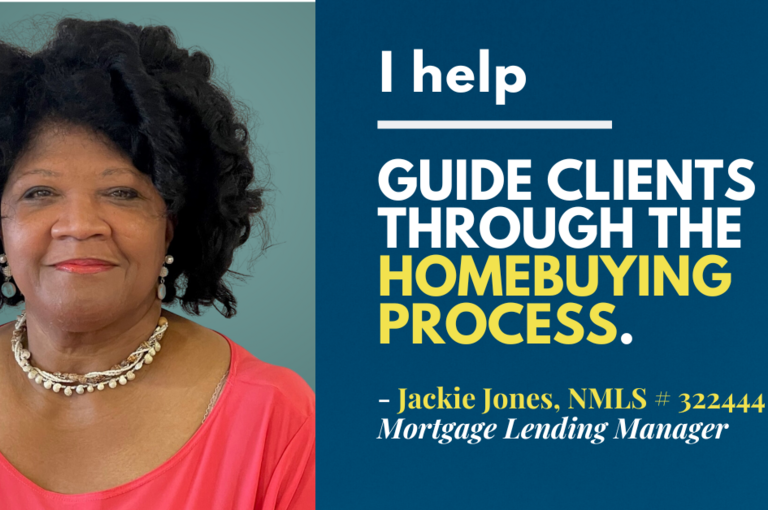

Jackie is our Senior Project Specialist, and what she loves most about working with BCL is that she can provide our clients with actionable steps that lead to positive results. “I always tell my clients, ‘After today, you won’t be able to say that you don’t understand how to purchase a home or access funds to assist you because you will get the knowledge that you need.’” They are ready to act on what they have learned.

Amidst the celebration of Hispanic Heritage Month, we sat down with our founder Rosa to share her perspective on being a Latina leader in the realms of economic development and finance. We discussed her challenges, her inspirations, and her unwavering commitment to empowering underserved communities.

The health and economic effects of the pandemic put people behind on their home expenses, such as mortgages, utilities, HOA fees, taxes, etc., and left them at risk of losing their homes. Barbara Rubles found herself in such a situation with being close to $5,000 delinquent on her mortgage.

BCL of Texas’ Austin Community Land Trust (CLT) Accelerator program awarded with $2 million in grant funding to continue working to prevent the displacement of renters and homeowners in Austin.

Across Dallas, there is a need to build capacity for existing and rising community-oriented developers; specifically people of color, bringing innovative solutions to increase housing affordability and community-based amenities in historically distressed communities.

Debt is a pervasive issue that affects millions of people worldwide learn some strategies client Jacqueline McCroskey used to reach financial freedom

For the past three years, BCL of Texas has supported youth entrepreneurship, thanks to a partnership between San Juan Diego High School Entrepreneurship Program and BCL’s Entrepreneurship Program.

I was born in San Felipe Guanajuato, a small town in central Mexico that rises 8,900 feet above sea level. My hometown was founded in 1521, in a historic region often referred to as La Cuna de Independencia, or “the birthplace of Mexican Independence”.

As Director of Entrepreneurship at BCL of Texas and working with diverse small businesses for over 20 years, I have a lot of aspiring entrepreneurs come to me and want to start a business as a means to build wealth, or have something to pass on to their children. That leads us to the question: Can your small business be a way to create generational wealth?

BCL is proud and grateful to have worked with the SBA to adapt to the new guidelines and rapidly accommodate the influx of PPP applicants. During the month of May, we dispersed our largest volume of small business loans ever in such a short period of time. In total, we loaned over $4.8 million to nearly 200 small businesses across the state during the second round of the Paycheck Protection Program.

BCL of Texas is delighted to announce $5 million in new funding since the beginning of 2021. This funding is critical to our mission and allows us to work with families, individuals, and businesses across the state to Build Strong Communities and create opportunities for building wealth and financial stability.

Before covid-19 hit, veteran-owned business Eagle Pride Supply was going strong - growing their business revenue 24-fold over just a couple of years. As an essential business providing supplies for government contracts and more, owner Patrick Myers was ready to weather the storm. But as smaller businesses shut down, suppliers tightened credit, and the consumer spending slowed, the effects of the prolonged shutdown began to affect his business too.

Avoid financial stress during the holidays by planning ahead. Identify your end goal to think through how you want to spend this season.

Founded in 2014, BCL’s Community Loan Centers of Austin and Dallas are a financial wellness program offered as a employee benefit to participating employers in our Austin and Dallas programs through employers like Parkland Hospital, United Way of Greater Austin, the Cities of Austin, Dallas, and Wilmer, and more.

When Travis County contracted BCL to administer their TCTX Thrive Small Business Grant Program, we knew that customer service and personal attention were going to be key for helping small business owners access the funds. Based on our 30 years of working with entrepreneurs, as well as seeing difficulties posed by other programs, we knew that navigating an online application portal and accessing a variety of financial documents and reports can be a burden on small business owners.

We go to a personal trainer to get in shape, a mechanic to get the car tuned up, and watch YouTube videos to learn a new song on the guitar. Yet, when we need to work on our budget, credit, or savings we often try to go at it alone.

A certified financial coach is trained to help clients get their finances in order and provide tools to keep emotions and old habits from getting in the way of making sound financial decisions.

BCL of Texas is pleased to announce the appointment of three new members to its Board of Directors, including Dora Zapata of Dallas, TX, Melissa Chamrad of San Antonio, and Larry Dovalina of Cotulla, TX.

For the past two months, we have all read and seen the glaring issues affecting people of color. Latino and African Americans are dying at higher rates from COVID-19 due to underlying health issues. We must acknowledge that 95% of Latino and African American businesses have not benefited from the CARES Act Paycheck Protection Program (PPP) because small, minority-owned businesses remain underserved by mainstream lenders. And to compound matters, the death of George Floyd and many other black men and women who lose their lives at home and on the streets at the hands of police all point to long term systemic racial and social injustice.

BCL processed just over $1,000,000 of PPP loans within hours of the Round 2 PPP opening. As promised, the SBA staggered the submission process to allow smaller non-profits and community banks a first opportunity to submit our loans for approval. The race to get PPP funding was slowed down so that small businesses could have ample time to get their documentation to their lenders. And unlike the first round of PPP that was allocated within a few days, there is PPP capital available and BCL is here to help with your application.

Today, May 5, 2020 is BCL’s 30th anniversary. As the founder of BCL, I am proud to state that we are the most diverse statewide non-profit Community Development Finance Institution in Texas. In 30 years BCL has funded a combined 13,000 loans for businesses, families and consumers. Our mission is to Build Strong Communities across Texas. The impact of BCL’s work is impressive. Over 36,000 individuals have benefited from BCL’s work. Whether it is achieving homeownership for their families, growing a local small business and contributing to the local tax base or building personal assets for modest income families, BCL has truly made a difference.

In past weeks, most businesses, communities, and families were forced to make decisions quickly. The pressure knocked many into researching various resources to maintain staff, income, health and stability, mostly using technology and digital resources to adapt. Our world is transitioning and efforts towards protecting the environment and sustainability should remain consistent.

Hello Family and Friends,

Growing up, I was taught that Sundays are holy days of obligation - days for prayer, solace, and introspection. As an economic, business, and community developer, my past weeks have been spent working around the clock, helping neighboring towns with new relief loan funds to approve close to 40 loans at zero percent interest, many of these loans forgivable after three payments.

Headlines and social media posts continue to educate our nation about the ongoing seriousness of the coronavirus in all our communities. As our nation, state, and local communities continue to take necessary actions to flatten the curve and ensure the health and safety of people, there is also the growing reality that this issue may persist for many months and it will touch all aspects of our society.

As a HomeOwnership Specialist, I see people every day for all kinds of hardships, from families facing foreclosure to young professionals trying to manage student debt. We know that 40% of Americans don’t have $400 in the bank to pay for an emergency expense.

During a normal moment in time, paycheck to paycheck workers are often only one emergency or surprise medical bill away from a financial crisis. During this period, we see so many Americans in an even more financially precarious position.

At BCL of Texas, the physical and financial health of our community has always been our biggest priority. As we weather the coronavirus pandemic, we know both individuals and businesses are seeing economic impacts across our state. We’re here to let you know that we’re here, we’re open, and we’re ready to support you. **In precaution for the health of both our staff and customers, we are moving the majority of our services online through May 1 and canceling or rescheduling in-person events. ** Here are the ways that BCL of Texas is here to work with you through this period:

BCL of Texas is here to support our entrepreneurs and small business owners who have been impacted throughout Texas. As public officials take precautions for the health and safety of our community, we recognize that small business owners may feel an economic impact.

We’re pleased to name Harry Looknanan, Jr., as BCL of Texas Board Treasurer, after one year of service on our Board of Directors.

Have you ever felt like you had so much debt you weren’t sure where to start even thinking about how to pay it off? Our customers Amber and Bryce, who paid off $40,000 in car and credit card debt in one year, have some advice: Go ahead and take the plunge now. “If you don’t jump now, your situation is still going to be the same a year from now,” Amber said.

In a political climate where grant dollars and subsidies are dwindling, many nonprofit organizations are finding it difficult to stay sustainable and continue to deliver much-needed services to their community, having to turn to alternative funds, such as borrowed capital, to follow through on their mission. As Director of Community Development for BCL of Texas, I recognize that when organizations must take on debt to continue their programs, that debt must be as flexible and affordable as possible in order to reduce the burden on those the organization is committed to serve.

A rising community star, BCL’s Andrea Allen was recently named an honoree for the 5th annual Who’s Who in Black Dallas awards.

With 15 years of mortgage industry experience, Andrea joined the BCL team in 2017 as Mortgage Processing Specialist. We sat down with her for a Q&A about what drives her passion for making a difference.

While entrepreneurship and small business ownership for minorities including African Americans has made some progress over the past 60 years, there is still much to be done. In his famed 1968 speech “I’ve Been to the Mountaintop,” to assert black independence, King called on followers to strengthen black institutions and businesses by moving their money away from the white run business and banking establishments and depositing their dollars into black owned institutions.

BCL is so proud to announce that Jackie Jones, our Director of Mortgage Lending, was named one of Mortgage Professional America’s Elite Women of 2018! MPA’s annual list features top women in the mortgage industry who are expertly leading and shaping a more diverse industry.

While we celebrate the growth of small businesses ownership in the U.S, sadly the African American small business footprint has grown only to 14% of the 28 million small businesses in the nation. Most of this minority group is woefully underserved regarding growth capital and capacity building support.

In October of 2009, my husband and I became first time homeowners. It was a huge accomplishment for us, and it gave us an opportunity to raise a family in our own home. Our first son was 8 months old when we became homeowners, and in 2014, we brought our second son home.

Port Arthur, Texas, a community of about 50,000 just east of Houston, feels at first glance like a city defined by a crisis that won’t let up.

A national poll from NeighborWorks America found nearly half of the taxpayers across the country expect to use their 2017 tax refund to strengthen their financial situation by either paying off debt or saving for the future. Financial capability counselors from BCL of Texas are ready to help you make the best decision possible when it comes to completing tax forms, saving and managing debt.

If you want to start a business, you’ve probably thought of using your savings, asking friends and family for help, putting expenses on your credit card, and applying for a traditional bank loan. The first two options work well, provided you’ve got a little socked away and your nearest and dearest believe in your dreams as much as you do. The third could put your personal credit in serious jeopardy, not to mention racking up some crazy interest charges. The fourth, traditional bank loans, aren’t always easy to come by when you’re an entrepreneur (perhaps surprisingly). That’s where microloans come into the picture.

It’s 10am in the office on a Wednesday and we’re comparing outfits to see who dressed best for the cold weather, and looking for reusable silverware and refillable water bottles for our eco-party. Later in the day, we all take a walk together, open the curtains to let in sunlight to warm the building, and compost our leftovers.

In all the headlines about destruction and rebuilding in the wake of Hurricane Harvey, one narrative is consistently missing: the small Texas towns outside of the Houston area that are dealing with the same devastating impacts, but with less infrastructure, less national attention, and less support.

BCL spent a full and productive day with community leaders discussing the future of Austin’s economic development policy this month. We expect to have some great information for our clients coming soon. And BCL of Texas Director of Entrepreneurship Brian K. Marshall was honored to participate in these key stakeholder discussions!

BCL of Texas stands in solidarity with our neighbors across Texas who have been affected by Hurricane Harvey. We stand ready to help, and to connect you to the resources you need to put your life and business back together.

Back to school season is upon us once again, and a parent’s job is never done. We hold many jobs, including being our children’s lifelong teachers. We don’t have all the answers and once in a while we need inspiration to be creative in our own household solutions.

BCL of Texas and its homebuilding subsidiary Texas Community Builders are committed to providing housing solutions with quality, attractive homes at a price tag that’s within reach for working families, veterans, first responders, educators, and more.

June is National HomeOwnership month, and the homebuying season is in full swing. Below are four tips to help you prepare to take the first step.

BCL celebrated 27 years of serving Texas communities with a public mural unveiling party this Cinco de Mayo at our Austin headquarters on South Congress Avenue.

Formed during an economic recession by rural Texas volunteers, CEN-TEX Certified Development Corporation (which would later be called BCL of Texas) has been bold and deliberate in its mission to build strong communities. As one of the co-founders, I have seen the growth and transformation since day one.

With 27 years of experience, BCL is committed to building strong communities across the state of Texas. Our toolbox consists of customized lending, small business, and homeownership solutions to promote economic vitality.

You may have noticed that things look a little different around here lately. BCL is greeting 2017 with a facelift to both our website and our Austin main office.

Do you have a passion to fix an existing problem? Maybe it’s an environmental, health services, or education-related issue. Either way, starting a nonprofit organization could be the best solution.

Are you a 710 or a 540? Your credit score has a crucial impact on your ability to be approved for loans and the interest rate you’re eligible for.

Suite 500 Austin, TX 78701 P: 512.912.9884 F: 346.301.5752 NMLS #1114924

Suite 1220 Dallas, TX 75208 P: 214.688.7456 F: 346.301.5752 NMLS #1114924

Suite 2 San Marcos, TX 78666 P: 512.383.0027 NMLS #1114924